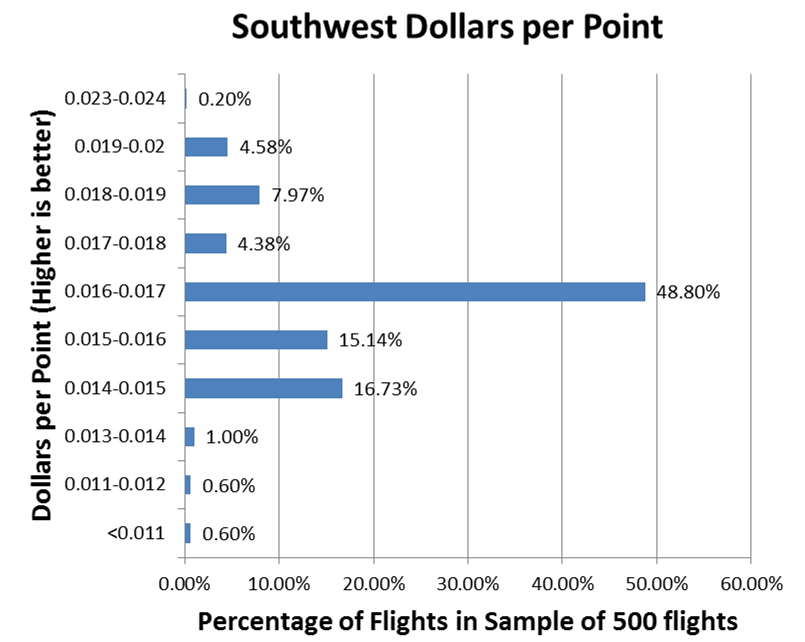

Southwest advertises the rate for redeeming Southwest Rapid Rewards Points at 70 points per dollar. That is equal to 1.4 cents per point. Now, if you’ve flown with Southwest, you’ve probably noticed that the points to dollars conversion varies from flight to flight.

I’ve pulled together some data from 500 flights on Southwest’s flexible date calendar to calculate how much the Rapid Rewards points are actually worth. These flights are domestic and set to take place in November 2016 thru January 2017.

Overall Southwest points are actually worth:

61.72 points per dollar. Lower is better for you.

$0.0162 dollars per point. Higher is better for you.

This is the average rate, so you can find many Southwest flights that offer much more generous point conversions. In my personal experience, Southwest offers some of the best conversion rates for points, and there are no black out dates. There are times that you can find a Delta Skymiles flight that is deeply discounted for points, but overall Southwest has more consistently generous reward flights.

Looking at the Flights Visually

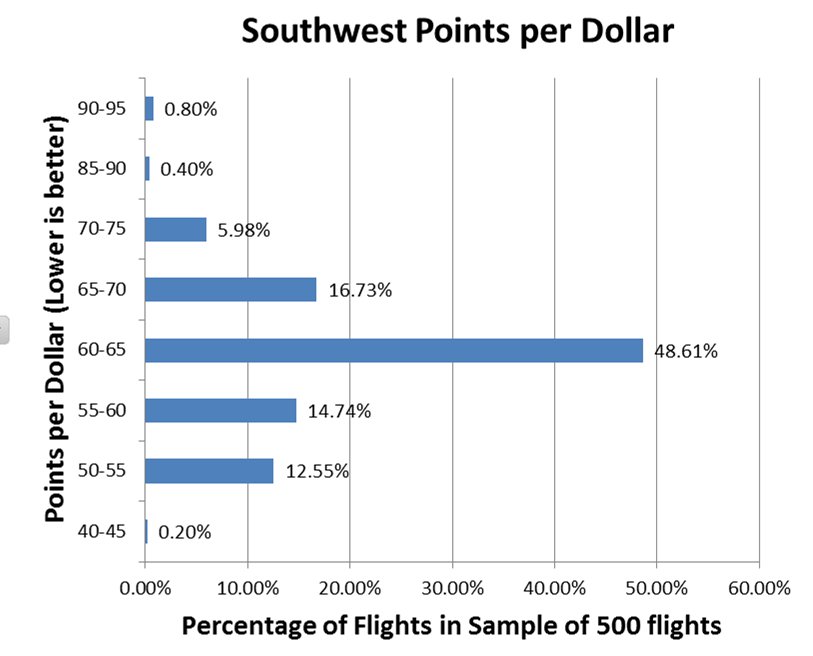

Looking at the the dollar per point values, only 2.2% of flights fall below the 1.4 cents ($0.0143) rate. 16.73% fall right around the advertised rate. A tremendous 81.07% offer a better dollar to point conversion that advertised.

Looking at the data by points per dollar gives a similar graph. The categories are slightly different than the dollar based one, which is why the distributions are slightly different.

Methodology

To get these numbers, I took the price of a flight in dollars and compared it to the price of the same flight in points. I adjusted the prices for the $5.60 fee per flight that is charged for any reward flights. For reference, here are some other point valuations. The numbers may vary because of the flights they checked and dates of those flights:

- NerdWallet : $0.011 dollars per point; 90.9 points per dollar

- The Points Guy : $0.015 dollars per point; 66.7 points per dollar