I was looking at my home's Redfin estimate chart, and the historical estimated property value was surprising when I noticed it said we overpaid by 10%. That was very surprising, since at the time several other units in our building were sold for the same price as what we paid. Plus, we purchased with a Redfin realtor and I would have remembered if there was so much of a difference between the estimated value on Redfin and the current price. I had originally thought that the historical value estimates represented the value that they thought it was worth on that date. For example, if it was Jan 2021, you would lock in an estimate and that was what would show up forever as the Jan 2021 estimate.

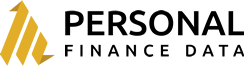

Redfin has been sending us an email with the estimate every month.

Lucky for us, we had signed up for Redfin's Home Reports a couple years ago which included a snapshot of the estimate at that moment, which is what I thought the graph originally represented. A lot of the emails also include a value for the percent change from last year or last month. Here's a plot of the results of those emails versus what was live on Redfin when I wrote this article.

Older Data is More Variable

Looking at my property as an example, there are some trends with more recent results being more consistent with the point-in-time estimates. The 2+ year old estimates are showing a relatively large amount of difference. An important fact to note is that the sale prices of comparable units in my building and neighborhood have been flat for this entire time duration. So it seems to me that their algorithm to pricing the estimates seems to trend towards painting a rosier picture of the market. The upward graph in the current price estimate does make me feel good, but it's really just fake.

Digging into the Details of the Change Since Last Year and Last Month

As I mentioned before, most of the emails contained an additional data point of change since last year or last month. None of those year-over-year or month-to-month changes was ever a negative, so I believe they must just omit the value if it isn't positive. Here is a chart with each email's data points plotted with the estimate from that month with a line that goes to the implied price based on the percentage change since last year or last month. These values (gray lines) are plotted next to the most recent Redfin Estimate.

The 2018's estimated values are all over the place with estimates ranging from $209k to $240k over a few months timespan.

Be a little cautious with the estimates

The values on Redfin can be useful, and I still use them frequently. But, this example has really highlighted to me how much these numbers can change over time on a whims notice. Now that I think about it, it's not too surprising to me that they restate their numbers historically as they update their data models. But what is really surprising to me is just how much the estimates can very month to month in a stagnant market.

Update 2022, I've updated the charts based on the last 2 additional years of data since I originally posted this. The estimates are still being heavily restated regularly. In fact, in the 2 weeks since I received my Home Report email there has been a massive lift in the value estimates from $255k in the email to $264k on the owner dashboard. In light of the recent Zillow fiasco where they tried to flip houses, I wonder if they had a similar issue with fudging the historical numbers. It certainly is much easier to make a model look far more predictive, if you get to backdate all your estimates.