The BBC recently reported that Wealth of people in their 30s has ‘halved in a decade’ in the UK.

I ran the numbers for the United States using data from the US Federal Reserve and the results are shockingly similar. Using data from the most recent report from the Federal Reserve, people in their 30s have had a dramatic drop in net worth from $57000 prior to the recession to about $25000 in the years after the recession. That is drop of over 55%! Even if you compare against numbers from 20 years ago, the wealth of people in their 30s today is half. Among the reasons for this are increased costs of education, reduced earnings, and higher health care costs.

Here is a graph showing the inflation adjusted median net worth trends of households led by 30 year olds every 3 years from 1992 to 2013 (the most recent survey available). All values are in inflation adjusted 2013 dollars.

Tips! Hover over the bars to see the exact amounts.

These trends are telling since this means that the younger generations are not able to build up the same levels of wealth as those who came before them. With the upcoming election, it is not surprising that the younger generations have been attracted to relative political outsiders such as Bernie Sanders, Gary Johnson and Jill Stein who promise greater opportunities to those who have not seen much of the benefit of the recovering economy.

Looking at the median income for these households, income for these same households has dropped 13%+, since the recession and has not yet recovered. It is not as dramatic as the drop in net worth, but that 13% drop has basically handicapped many young adult households from being able to save.

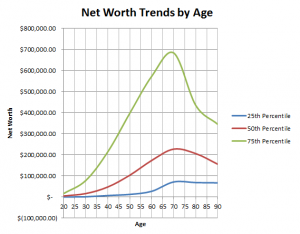

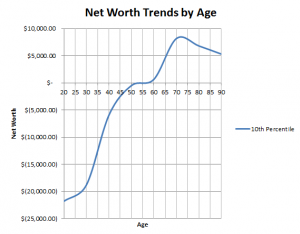

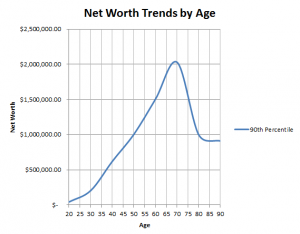

The data for these charts came from the US Treasury. All of this data is freely available there for you to perform your own analysis and fact checking.

If you would like to play around with the 2013 net worth data, check out the net worth rank calculator. Net worth is defined at total assets minus total debts, including housing, vehicles, cash, investments and retirement accounts.