The best thing about tracking and setting goals is that you are in total control of what you want to track and how you want to track it. At work, I typically have goals and metrics cascaded down to me from above whether or not I agree with those metrics and goals. For my personal finances it’s freeing to be able to set my own goals and decide how I want to measure success. Read on for examples of metrics and processes that you could use to track your financial goals and progress.

How I’m tracking this year

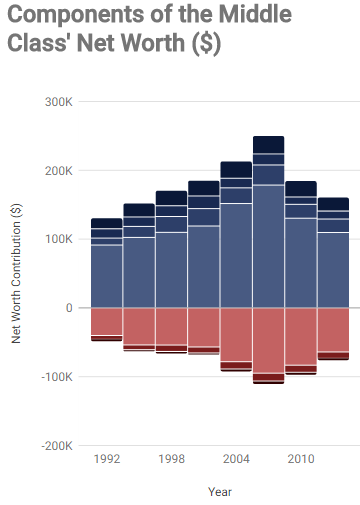

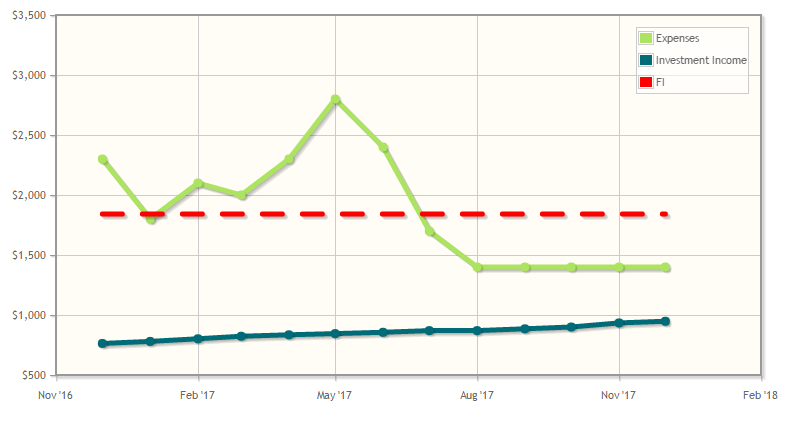

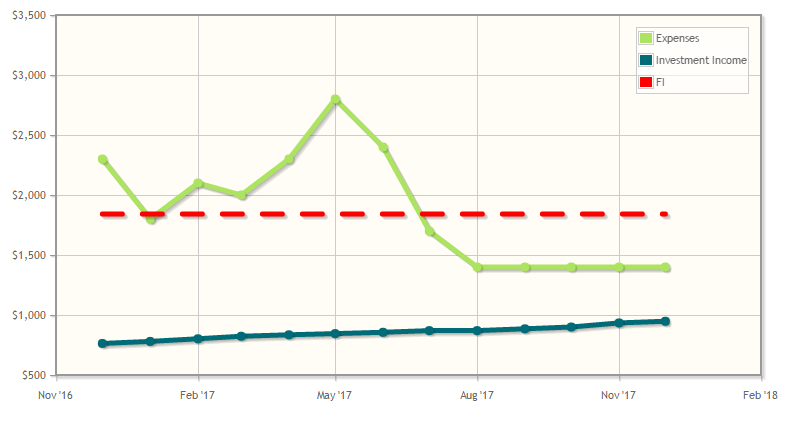

For this year, I decided to set my goals by loading my planned spending, income, and net worth in MadFienst’s lab and compare my end of month actuals to the plan. As each month goes by, I overwrite the planned numbers with actuals. Here’s an example graph with actuals thru March.

How other people are tracking their goals and measuring their stats

I frequent the Rockstar Finance Forums and one of the things I wanted to find out was how others measure their financial success. I reached out to some of my fellow forum goers to get some new ideas. Here some of them.

1. Setting SMART goals (specific, measurable, achievable, relevant, timely)

To recap, in 2017 I’ll measure how I’m doing financially on the following goals:

- Increase year-over-year net worth growth with 50%

- Invest 10% of my take-home pay in the stock market

- Establish a concrete plan for building a new source of income

Probably not the most ambitious goals for a year, but I’m content with setting goals that’ll allow me to spend little time thinking about finances right now. The first two are done more or less by the “autopilot” I’ve set up to manage my finances. –

Better Goals for A Better Year – Abovare

2. Tracking year over year percentage increases

I do a monthly Net Worth check up and use the value $10,000 as my over/under on a good month. That would represent about 7/10’s of 1% increase. If I hit it 12 months a year I get an annual up 8.3%, I am good with that. I also do a year to year comparison in October (have been for 10 years) to see what % I am up for the year compared to other years. This fluctuates a lot but averages, 21.9% up a year. Year Over Year Net Worth – Othala Fehu

3. Focusing in on simple goals like generating passive income

I keep things simple. Long ago I worked out what it costs to be me, to live my life largely how I want it to be. Bollocks to frugality and minimalism and all that compromise.

I then set about building a passive income generating machine to fund that lifestyle.

In a given month where I earn more than I need, I do the happy dance and embarrass the hell out of my kids.

Alternatively should I earn less than that I curse the financial gods, before slapping myself upside the head for not being accountable for my own f*ck ups. Then I go figure out where things went awry.

Usually it is something simple like a void period between tenancies, or the result of a significant splurge such as an extended holiday.

On the rare occasion that it isn’t so easily explained I go looking for the underlying reason… maybe lifestyle inflation, or perhaps an increase in fees or interest rates or whatever.

In summary: Celebrate the small wins, which means if you’re doing it right you’ll be celebrating often. When you’re not figure out why, then do something about it. And repeat. Cantankerous.life

4. Managing spending

We mainly look at our spending. We automated our investments and only invest in index funds so the investing part is pretty straight forward. On the spending side, we focus on our biggest expenses and try to cut down all the fluff. Open Book Frugal – Our Financial Path

5. Managing debt and looking forward to milestones

I do a monthly net worth check and want my net worth to go up more than the previous month’s change. Now that I’m out of the bad debt repayment portion of my plan and more into the stock market, that is sometimes difficult with the crazy market fluctuations. So to keep it going up, I’ve got to keep paying more into savings/investments and to keep paying down the “good” debt.

I also look to hit some major milestones every year and if I don’t, I don’t consider it a success. Things like max out 401k contributions and increase in savings/non-retirement investments. I also have some spending goals like home renovations and car purchases that I want to pay for in cash. And a cool vacation for the mental break from everything!80-20 Your Finances

6. Publicly tracking and reporting on your status

For the last couple months I have been doing a monthly net worth check and, this month I started posting it on my blog http://buybackfreedom.com/march-monthly-report/3

I also posted my goals, they are very simple at the moment, I want to hit a net worth number by the end of the year and I want to invest 3k into dividend yielding stocks. Every month from now on I’ll simply look at how much time there is left in the year to see if I’m saving enough or if I need to bump that number up next month. Buy Back Freedom

7. Using Mint to budget and track spending

This is an awesome idea for a post. I track our budget closely with Mint to make sure we’re staying on track with our spending. I also track our net worth each month using Mint and Personal Capital. Based on what we’re spending, how much money we’re putting towards our debt, and how much our net worth has grown, I get a good idea on whether we’re continuing in the right direction.

Here’s a post where I talk about my goals for 2017:End of Year Review & 2017 Goals – Spill Spot

8. Using personalized spreadsheets of spending.

I use Personal Capital and lots of Spreadsheets. I track monthly spending, update net worth monthly, and track net worth growth goals year over year, and I also have a retirement accounts growth projection / goal tracker with a countdown to what we need. Life Zemplified

9. Being analytic to create rolling averages to track progress versus budget.

We track our income, expenses, and net worth in Quicken and monthly we prepare a spreadsheet to show our progress compared to our budget, including a rolling 12-month average of actual expenditures in each category. We then make revisions when necessary to get us back on track to achieving our desired results. Our 5 Big Personal Finance Goals for 2017 – Super Savings Tips

9. Tracking net worth and tracking cash flows

I measure my net worth each month, and have done for some years.

I’m reasonably relaxed about investments ups and downs, but monitor our cash movements like a hawk!

i.e. we should be £x up this month, but we’re only £y – why? I allow for regular savings etc, but I expect our monthly cash to build each month, until I move it to an ISA / savings account, so if it hasn’t gone up as much as I expect – time for a deep dive!Cracking Retirement

Last updated:Thursday, February 2, 2023