Years ago, I used to wonder what my future in supply chain management would be like. With so many different career paths ranging from purchasing, warehousing, transportation, manufacturing, there were a lot of variables to consider. Now with years of experience behind me, I decided to collate together several supply chain salary surveys together. I can compare how well I’ve done in comparison and see what might be coming in the future.

Salaries rise quickly but plateau

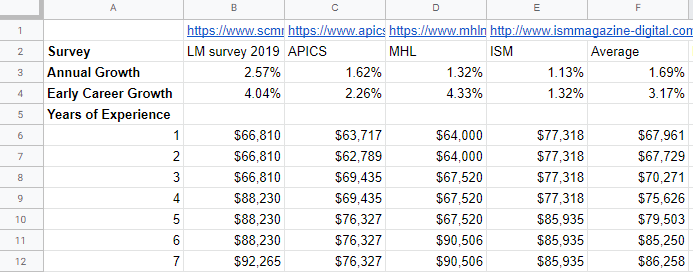

As you can see, salaries start at around $67k on average early in a career. They slowly rise to $120k towards the end of a career. This implies that the natural rate of growth per year of experience is about 1.69% annual raises (assuming no inflation) over a 40 year career. That isn’t terrible but isn’t great either. In the first 10 years, the gains per year of experience are significant as the growth rate is nearly double at 3.17%.

The mid career plateau is very evident in that flat section around 10 years of experience to 25 years. At this point in your career people are moving into senior roles. In corporate, that would be senior individual contributor role like managers with no direct reports or senior analysts. In field positions this would be similar to being a manager who is directly still leading front line workers.

The growth rate implied for these years is barely above zero at 0.28%. From my own experience, this period time causes a lot of soul searching. The first few promotions were comparably easier to earn, so hitting that individual contributor cap might feel like a ceiling. And, this frustration boils over into turn over as people get past up for promotions or opportunities. Also some people get complacent and get expensive relative to their output/skill-set. This becomes a risky position during layoffs when a cheap new grad may start to look like an affordable replacement for a senior associate with stale set of skills.

I think I’m getting to the Plateau

I used to worry myself with questions like how quickly should I be promoted. Or I would compare myself too much to my peers and how they were being rated. It’s hard when you’re starting out to figure out what’s normal or not. Looking at my own personal growth, my income started a little bit below the average but quickly shot up as I got performance reviews and promoted. After that whirlwind of upward trajectory, I am getting the feeling that I’m approaching the plateau. As I’m compensated well above average at this point, but I don’t really have an interest in management yet. When I look at my career progression and prospects there isn’t a lot unless I do pursue management or switch into something much more technical like data science.

Sources and Methodology

I created the graph using the listed supply chain salary surveys. The average line is all 4 survey averages averaged by years of experience, the Highest Survey Average Salary represents the survey with the highest value for that experience, and the Lowest Survey Average Salary represents the lowest value for that experience.

- Logistics Management

- APICS Salary Survey 2018

- Material Handling and Logistics 2018 Salary Survey

- Inside Supply Chain Management 2018

Because the years of experience ranges were not exact matches, I populated this table with each year of experience and listed the salary for the experience range for each year. I then averaged across using those values:

Interestingly, the 21-29 age range on MHL salary is $58.7k, which is lower than their listed cohort of 1-2 years at $64k. This seems to suggest that people entering the supply chain profession are slightly older than the 21-29 age group. They also probably have professional experience in other areas. If you are a recent or incoming college graduate, do not despair if your salary is more in the $50ks. It’s totally normal. Your salary will grow quickly if you work hard and show some aptitude.

Since only one of the surveys provided median and average numbers, the numbers presented are using averages. You should keep in mind some highly compensated employees will be represented in the more experienced buckets. Also a lot of these surveys don’t have very deep survey pools and tend to only ask their membership for responses. This could be a problem because the people who are in these trade groups tend to be more involved at work or are high potential individuals who probably earn more.