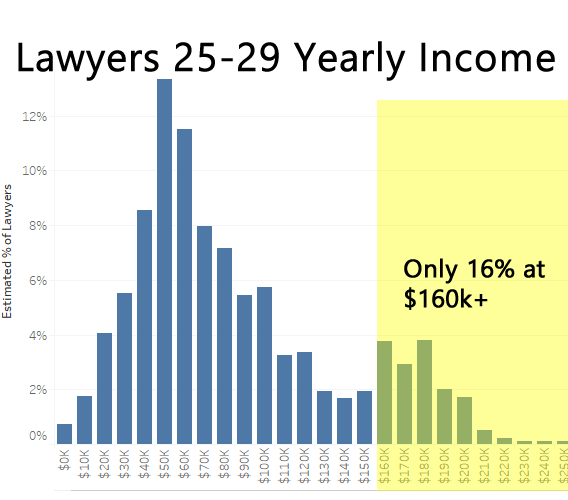

It’s a common refrain that law salaries for new grads are bi-modal, with a large percentage of law graduates going into Big Law. The NALP even publishes data that shows a double humped distribution of salaries every year. But a quick query of freely available American Communities Survey data (collected by the US Government) shows that there is a small hump in the same spot that the NALP survey reports. But NALP shows nearly 21% of graduates with income around $185k / year and it looks like roughly 26%+ are earning at least $160k which looks to be a huge overstatement. This is what I found:

Only 16% Reported Income Near that Range

- Mean : $91,798 / year

- Median : $75,000 / year

- 25th Percentile : $51,771 / year

- 75th Percentile : $119,976 / year

I have read comments questioning some of the data collection methods that NALP uses, and I think that this single slice of data definitely shows that there is an odd deviation from the results I derived from the ACS. If anything my data should skew higher, because I could not separate people with only 1 year of experience out. So there would be associates with in Big Law with multiple years of raises and experience in this data set. An interesting overlap is that the NALP’s adjusted mean is slightly below the mean salary that I have calculated, which is interesting as to how close it is.

Methodology

- ACS 5 Year 2013-2017 Micro-data

- Industry : Legal services so this would be limited to law firms specifically.

- Ages 25-28 to try to capture new grads specifically with at least one year of work, there was no way to restrict years of experience.

- Occupation : Lawyers, and judges, magistrates, and other judicial workers (This was the lowest level, I could separate it at, but I doubt there are a lot of Judges/Magistrates/Other in this age range)

- Education: Professional degree beyond a bachelor’s degree (Could not be more specific)

- Weeks worked prior year: >40+ weeks / year (to try to exclude people who were reporting income from partial year internships/clerkships)

- Hours Worked in a usual Week : >35+ hours / week (to try to get only full time)

- Currently Employed