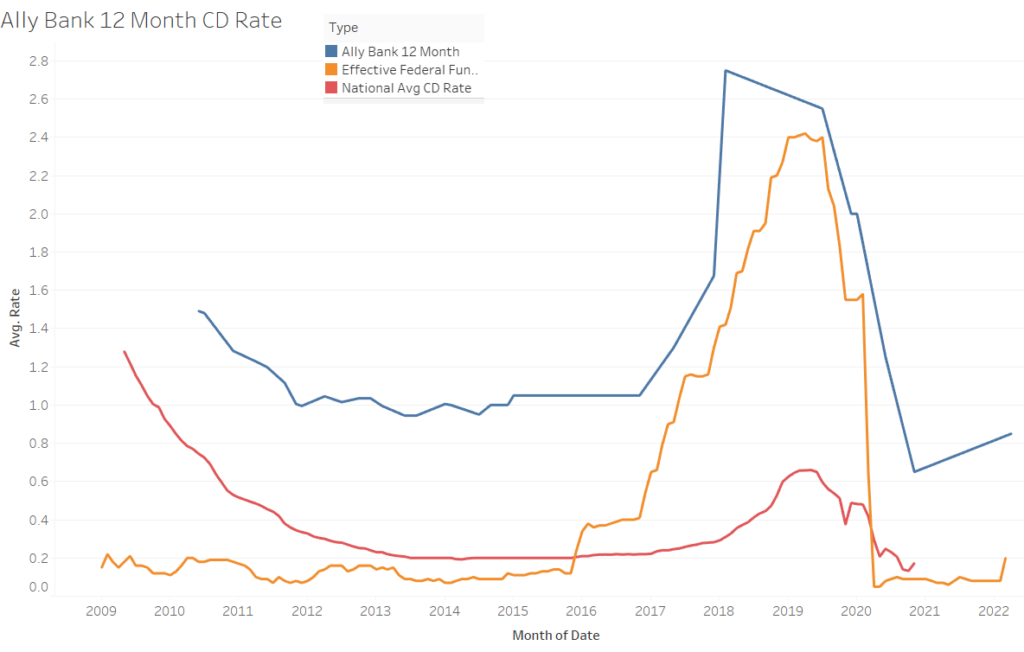

I included the Federal Funds Rate (source: St Louis Fed, Federal Funds Rate) as a comparison as this is the rate that banks lend to each other. You can see the spike in Ally Bank rates generally following increases and decreases with changes to the Federal Funds Rate. So if you’re on the fence about figuring out when is a good time to lock in a rate with Ally Bank on a CD, just look at how the Federal Funds rate has been trending.

In addition, I included the national average for the 12 month CD rates (source: St Louis Fed Avg 12 Month CD). This average seems to be less responsive to the Federal Funds rate, but still shows some similar movement. The 12 month CD rate feed apparently was discontinued, but I’ll leave it up for now since CD rates in the missing time frame (2020-2022) have basically been <1%.

Table of Ally 12 Month CD Rates 2010-2022

| Date | APY | Source |

| 6/6/2010 | 1.49% | Web Archive |

| 7/17/2010 | 1.48% | Web Archive |

| 12/5/2010 | 1.29% | Web Archive |

| 12/26/2010 | 1.28% | Web Archive |

| 4/26/2011 | 1.23% | Web Archive |

| 6/22/2011 | 1.20% | Web Archive |

| 9/25/2011 | 1.12% | Web Archive |

| 11/30/2011 | 1.01% | Web Archive |

| 12/31/2011 | 0.99% | Web Archive |

| 4/21/2012 | 1.05% | Web Archive |

| 5/4/2012 | 1.04% | Web Archive |

| 7/25/2012 | 1.02% | Web Archive |

| 10/5/2012 | 1.04% | Web Archive |

| 11/27/2012 | 1.04% | Web Archive |

| 12/28/2012 | 1.04% | Web Archive |

| 2/9/2013 | 0.99% | Web Archive |

| 6/3/2013 | 0.94% | Web Archive |

| 7/30/2013 | 0.94% | Web Archive |

| 8/8/2013 | 0.94% | Web Archive |

| 1/22/2014 | 1.01% | Web Archive |

| 2/14/2014 | 1.00% | Web Archive |

| 7/9/2014 | 0.95% | Web Archive |

| 9/3/2014 | 1.00% | Web Archive |

| 12/3/2014 | 1.00% | Web Archive |

| 1/29/2015 | 1.05% | Web Archive |

| 4/26/2016 | 1.05% | Web Archive |

| 11/29/2016 | 1.05% | Web Archive |

| 5/3/2017 | 1.30% | Web Archive |

| 12/1/2017 | 1.35% | Bankrate |

| 12/20/2017 | 2.00% | Fat Piggy |

| 2/15/2018 | 2.75% | Web Archive |

| 7/9/2019 | 2.55% | Web Archive |

| 12/13/2019 | 2.00% | Hustler Money Blog |

| 1/26/2020 | 2.00% | I pulled this |

| 6/14/2020 | 1.25% | Web Archive |

| 11/27/2020 | 0.65% | I pulled this |

| 4/24/2022 | 0.85% | I checked this |

| 9/2/2022 | 2.7% | Email archive |

| 9/22/2022 | 3% | Email archive |

| 9/25/2023 | 4.85% | I checked this |

Note for anyone else, I had some trouble with the Web Archive providing inconsistent results on the pages I was using to get the interest rates from. This is why for some of the more recent recordings, I used blog posts to get the rates. I think there is some kind of issue with how the data is saved since it looks like the data is loaded by javascript I think my browser is caching the javascript file with information from a previous snapshot.

Recorded 9/25/2023

- 9 Month: 5%

- 12 Month: 4.85%

- 18 Month: 5.15%

- 3 Year: 4.25%

- 5 Year: 4.1%

Recorded 4/24/2022

- 9 Month: 0.5%

- 12 Month: 0.85%

- 18 Month: 1.25%

- 3 Year: 1.5%

- 5 Year: 1.5%

Recorded 11/27/2020

- 9 Month: 0.5%

- 12 Month: 0.65%

- 18 Month:

- Less than $5k Deposit : 0.7%

- $5k – $25k Deposit : 0.7%

- Greater than $25k Deposit: 0.7%

- 3 Year:

- Less than $5k Deposit : 0.75%

- $5k – $25k Deposit : 0.75%

- Greater than $25k Deposit: 0.75%

- 5 Year: 1.0%

Yikes what a few months can do to rates. I just saw they’re at 0.9%. what a drop in only 6 months!

These rates are ALL wrong after 2021. Way off.

I’ve added some additional snapshots based on my emails and my own CDs. The rates really shot up after my last update in early 2022.