I recently came across a new metric, the Green Swan’s FIRE Prowess Score, to measure my progress in achieving financial independence / early retirement. It’s an interesting twist on a savings rate calculation. Like many savings rate metrics, it is tied to your gross income (pre-tax), but the amount that you save is your change in net worth.

The Formula

It is calculated as:

| Annual Change in Net Worth ($) |

| Annual Gross Income ($) |

The thing I like about this formula is that is builds in a measure that combines your gross income with your net worth growth. The ratio takes into account growth in equities and retirement. For more specifics on the basic thoughts read TGS’s article about it.

Comparison of Savings Rates

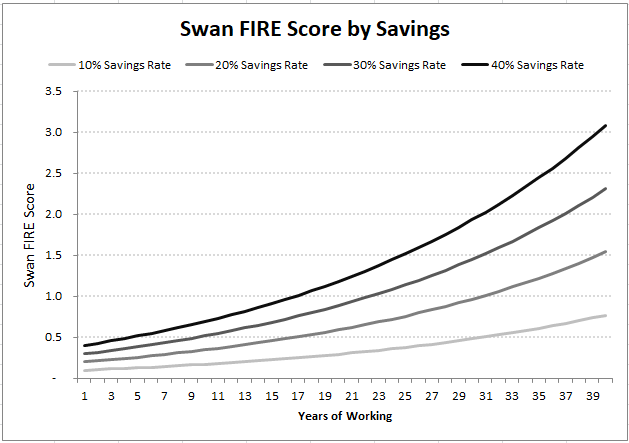

To show the difference between this metric and a regular savings rate, I’ve created a couple rough scenarios and tables using a theoretical person who has these stats:

- Savings rate of 10%, 20%, 30%, or 40% every year for up to 40 years of working

- Annual equity growth on savings of 7%

- Annual income growth rate of 2.5%

I really like to benchmark how I’m doing versus a goal, which is why I made this. The assumptions are pretty crude, but I think for a general goal this is good.

As you can see in the graph over time, the person’s Swan score continues to scale even though their savings rate is steady. I think it really demonstrates compounding growth and the importance of earlier savings versus later savings. Here’s a link to the spreadsheet I used so that you can play around with some of the assumptions Swan FIRE Score by Savings Rate.

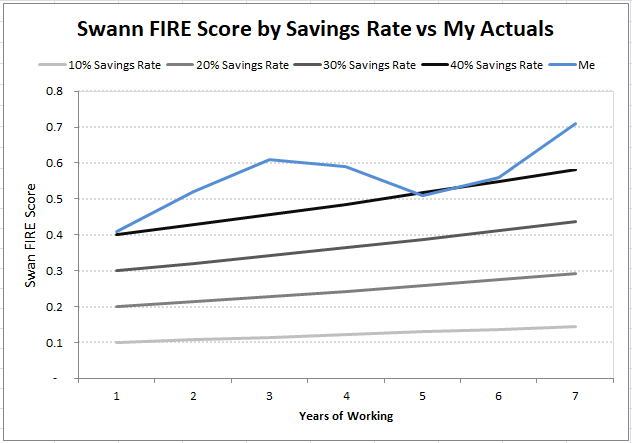

My Score vs the Standard Savings Rates

I’ve been working 6 years after college so far, and my usual results vary between 0.41 and has grown to 0.71 for my project year ending score. My lifetime rate has been 0.54. [Update as of 2022 I’m at about 0.7 but 2021 had me at 0.8. It’s too bad the stock market hit a big bump.] I’m using some data pieced together from the Social Security Administration on how much I earned each year, and then my net worth readings are from end of year. According to TGS, my score is good and will bring me on the track to FIRE eventually. I’ve decided that my target comparison rate is with the 40% savings rate scenario.

As you can see in the graph, my performance has been at or above that rate for the past 7 years. Full disclosure, my actual savings rate varies between 40% to 50%, but I like to sand bag my goals. In addition, the last 6 years looks great partially because of the booming stock market. But let’s say this was 2008, the metric would be depressingly negative. I think overall this is a good metric, because it definitely gives some standards to reach for. I’ll probably keep a log updated every now and then with this score.

Read Related Posts

A few other bloggers are also running related posts on topic, so we all got together to post at the same time. This way you can get a diverse perspective on it.

Edit: 4/2/2023, wow what a different world it was back when I wrote this. The landscape of personal finance bloggers has changed a lot, and it looks like the Green Swan shut down and their domain got scooped, so I’ve switched out a couple to archive.org links. So sad to see over half the gang going to dead links now, but I’m keeping their ratios for historical purposes.

- Anchor: The Green Swan – The Swan’s FIRE Prowess Gauge 2016: the one who started it all. 132% Lifetime: 93% (ARCHIVE)

- the Retirement Manifesto – Is Your Wealth Building On Track?. A big thanks to Retirement Manifesto for setting this up! 2016: 57% Lifetime: 44%

- OthalaFehu – My Swan FIRE Prowess Numbers Othalafehu has 10 years of personal data including the recession. 2016: 72% Lifetime: 61%

- Budget On A Stick – My FIRE Prowess Score 2016: 52% Lifetime: 55%

- DadsDollarsDebts: DDD’s FIRE Prowess Score 2016: 26% Lifetime 32%

- Debts To Riches – My FIRE Prowess Report Card 2016: 29% Lifetime 43%

- Adventure Rich – The Adventure Rich FIRE Prowess Score 2016: 45% Lifetime 47%

- Freedom Is Groovy – The Groovies FIRE Prowess Score 2016: 163% Lifetime 90%

- Working Optional – Calculate Your Progress To Financial Freedom 2016: 97% Lifetime 75%

- Life Zemplified – FIRE Prowess Score for Life Zemplified 2016: 78% Lifetime 76%

- Physician’s Wealth Services – Physician Wealth’s FIRE Prowess 2016: 43% Lifetime 46%

- Married And Harried – Married And Harried FIRE Prowess Score 2016: 32% Lifetime 14%

- Ms. Liz Money Matters – Introducing the FIRE Prowess Score 2016 279% Lifetime 72%

- Actuary On Fire: The Swan’s FIRE Prowess Gauge – My Results 2016 61% Lifetime 59%

- Budgets Are Sexy – My Total Lifetime Wealth Ratio: 2016: 135% Lifetime 60%

- Trail to FI: FIRE Prowess Score, Trail to FI Edition 2016: 34% Lifetime: 53%

- Maximum Cents: Maximum Cents’ FIRE Prowess Score 2016: 94% Lifetime: 70%

- Retiring On My Terms: ROMT’s FIRE Prowess 2016: 119% Lifetime: 57%

- Minafi: The Minafi FIRE Prowess Score 2016: 74% Lifetime: 94%

- Military Dollar: FIRE Prowess Scores & How to Correct for Military Paychecks 2016 81% Lifetime 83%

- Finance Yo Self: FIRE Prowess Score for Finance Yo Self 2016: 44% Lifetime: 44%

- The 7 Circles: FIRE Prowess Gauge 2016: 246% Lifetime: 219%

- Money Metagame: The Good, Bad & Ugly of the FIRE Prowess Gauge 2016: 108% Lifetime 68%

Awesome post, Shnugi! I love the benchmarks to various savings rates.

Yes, 2008 definitely took a toll on my FIRE Prowess score…it was actually negative for the year! Ouch. But my 5-year rolling FIRE Prowess score shows the more smoothing effect of market performance. And that is exactly why I’m a buy and hold investor (100% in the stock market). Over the long term stocks have the best performance…just more of a bumpy ride.

Keep up the great work. I hope you enjoy tracking your FIRE Prowess score as much as I do! Thanks for joining the “chain gang”.

Thanks for starting up a great topic!

Cool, Shnugi adds a nice new element to the discussion with his awesome “theortical” FIRE Score chart! First one to a score of 300% wins! Congrats on great performance. Thanks for joining “The Chain”, you’re officially in as Link #4!

Thanks I tried to add a little new spin on it, since you and Green Swan already did a great job!

Just a reminder to add my post to Link 17. Maximum Cents: Maximum Cents’ FIRE Prowess Score https://www.maximumcents.com/maximum-cents-fire-prowess-score/ 2016: 56% Lifetime: 70%

Will do! Sorry I took a week off.

Wow you are doing awesome!!! I’ll have to jump on this and join in. Thanks for sharing!!!

Great post. it is the best post for people like my father. After reading this I am sure, I can help my father to save more. I really appreciate your work. Thanks for sharing this with us.