I don’t normally go into politics, but this topic seems to touch a little more closely to FIRE, since there are specific growth rate assumptions that were made.

Buried under the headlines over how much Jeff Bezos would be taxed under Elizabeth Warrens Medicare for All plan was a side note on an additional tax to target the top 1% of households by net worth for a new tax called “mark to market.” This tax basically would restructure capital gains to take place every year regardless if there was a sale. Warren’s plans referenced a study freely available, if you’d like to read it yourself. The researchers used the Survey of Consumer Finances by the Federal Reserve, which is what powers many of the comparison calculators on this website.

To be in the top 1% by using total net worth, you would have to have $10.350 million in net worth to be in the top 1% of households based on the last survey results available using 2016 data. The authors don’t mention if they adjusted out any assets from their projections, so I’m going to assume not. The paper referenced by Elizabeth Warren referenced uses a rather optimistic 8.33% return on investments (page 30 of the PDF).

Over estimated returns

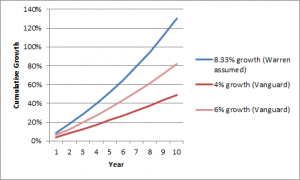

Vanguard is projecting a average annual returns of only 4-6% for US equities. 86% of the top 1% are over the age of 50 so their asset allocations are most likely more conservative than the overall stock market, and would likely grow much slower than the 8.33%. So with those 2 factors combined, most likely the $2T incremental tax contribution is very over stated especially considering the effects of lower compounding growth.

Shortfalls will need to be filled with other taxes

Using the 8.33% growth over a decade you would end up with 130% cumulative growth, but with 4-6% over the decade the growth would only be 49%-82% so the taxable gains would be 37% to 69% of the budgeted $2T which would cause a short fall in taxes of $0.6T to $1.3T.

Months ago, Warren and others had mentioned only targeting the wealthiest of the wealthy for the incremental taxes to pay for Medicare for All among other plans. The first primaries are still months away and Warren’s tax plans have started to dig further and further down the wealth ranks. Sure, people with $10m+ dollars in net worth are probably going to be fine. But if there are shortfall like the one I mentioned, where is the incremental money going to come from? A tax on $1m+ net worth households (top 10% by net worth) doesn’t look as implausible any more as the standards of who should be taxed keeps falling and falling.

She was the first candidate to release her plans and I’m sure she’ll address it in more detail later.