So I started thinking, I already have a lot of money saved up. I’d like to keep working until I’m in my 60s to at least have something to do. But how much do I actually have to earn? Right now, I’m right around the cusp of breaking six figures (depending on the bonus), but I only spend a relatively small fraction of that.

At work I have a lot of visibility to senior management, and the worst part of my job is being stuck in between the arguments of leadership of different divisions. On Monday we had a 15 minute meeting first thing, my Director announced that she was leaving the company. I relied a lot on my Director to deflect some of the politics and without her, I felt naked. After reflecting a little bit more on my work, I don’t think that I want to keep advancing up this path, because at this point that higher I’d advance the deeper I’d dive into the wonderful world of corporate politics.

I made another calculator

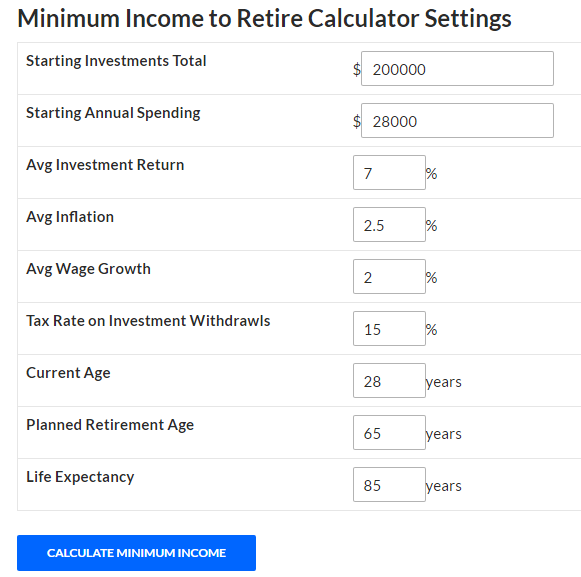

I whipped up the minimum work calculator to help me figure this out. Here are the settings that I plugged into it:

I reduced the wage growth a little bit just for a little security.

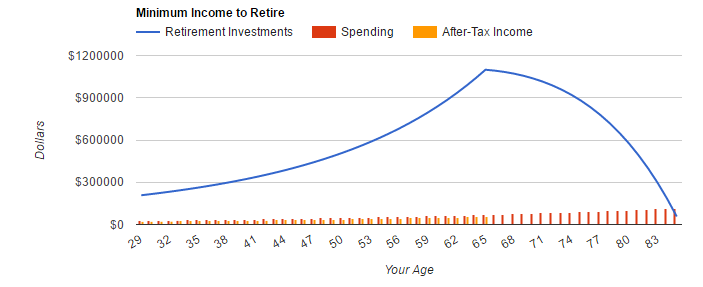

After a handful of CPU cycles, it spit out $22,400 per year post-tax or something like $24,640 to $26,880 pre-tax. Whoa, it’s lower than my spending, how does that make sense?

Well, the model is making the assumption that my $200,000 in starting investments will grow the first year by $14,501 (principle * e ^(rate * time)) with no withdrawals. The calculator looks at this and says, I could use part of that growth to live off of and still have enough left over to fund my retirement. This is what it ended up doing for year 1 (hover over the result graph to see the numbers).

At the end of year 1 (Age 29):

Spending: $28,700

Post-Tax Income: $22,967

Starting Investments: $200,000

Ending Investments: $207,659

By living off of my investments, I would have needed $5,733 to cover the gap between my income and spending. So in order to fund that income gap, my investment growth was reduced $6,842 to cover the $5,733, plus taxes, and plus loss of investment growth. Now, I would actually never want my spending to exceed my income before retirement, but at least it’s nice to know that I’d have a little leeway.

Here’s the chart that it spit out:

With the results, I feel at least a little better that I would probably be okay if I left my job for whatever reason and found a less stressful one with lower compensation. This minimum amount would be my low bar, so anything over it would mean that I would be able to preserve my standard of living and still retire with more leeway.

Right now, my plan A is to hang on to my current role for as long as possible. If anything happens, Plan B doesn’t look so bad.